Estimated reading time: 13 minutes

Introduction

The art market has undergone remarkable transformations over the past century, evolving from traditional auction houses and galleries to encompass a wide array of unconventional sales platforms. This dynamic landscape has been shaped by various economic, cultural, and technological shifts that have redefined how art is bought and sold. Conventional art sales, typically conducted through established auction houses and galleries, have long been the cornerstone of the art industry. These venues offer a structured and often prestigious environment for transactions, providing artists and collectors with a sense of legitimacy and historical continuity.

However, the emergence of unconventional art sales has introduced new dimensions to the market. These include online auctions, private sales, art fairs, and even social media platforms, which have democratized access to art and opened up new opportunities for both buyers and sellers. This diversification has allowed for a broader range of artistic expressions and has made art more accessible to a global audience.

This comprehensive analysis aims to explore the intricate dynamics of both conventional and unconventional art markets over the last 100 years. By examining key trends, sales data, and the impact of technological advancements, we seek to provide a nuanced understanding of the art market’s evolution. Readers can expect to gain insights into the factors driving these changes, the economic implications for artists and collectors, and the future prospects of the art industry. Through this exploration, we hope to illuminate the complex interplay between tradition and innovation that continues to shape the world of art sales.

Historical Overview of Conventional Art Sales

The history of conventional art sales is a rich tapestry interwoven with major movements and periods, each contributing to the evolution of the art market. The early 20th century marked the rise of Modernism, with notable figures such as Pablo Picasso and Wassily Kandinsky revolutionizing the art world. This period saw a gradual increase in art sales, with auction houses like Sotheby’s and Christie’s cementing their roles as pivotal players in the market.

As the mid-20th century approached, the art world witnessed the emergence of Post-War art, characterized by the works of Jackson Pollock, Mark Rothko, and Andy Warhol. This era saw a surge in the valuation of art, driven by a growing appreciation for abstract and avant-garde styles. The 1960s and 1970s were particularly significant, with record-breaking sales such as the $5.5 million for Van Gogh’s “Irises” in 1987, marking a milestone in the conventional art market.

The late 20th century and early 21st century ushered in the Contemporary art movement, featuring artists like Jeff Koons, Damien Hirst, and Banksy. This period experienced unprecedented growth in art sales, with the market becoming increasingly globalized. Noteworthy sales include the $110.5 million auction of Basquiat’s “Untitled” in 2017 and the $450.3 million sale of Leonardo da Vinci’s “Salvator Mundi” in the same year.

Statistics reveal a steady climb in the overall value of art sales over the decades. For instance, the global art market’s value was estimated at $64.1 billion in 2019, reflecting a compound annual growth rate of 6% since 2000. The prominence of high-end auction houses such as Sotheby’s and Christie’s has been instrumental in this growth, consistently breaking records and setting new benchmarks for art valuations.

In summary, the historical trajectory of conventional art sales is marked by significant milestones, influential movements, and iconic artists. The interplay between these factors has not only shaped the market but also underscored the enduring appeal and value of art across different eras.

Emergence and Growth of Unconventional Art Sales

In the past few decades, the art market has witnessed a dramatic shift with the emergence and growth of unconventional art sales, especially in areas like street art, digital art, and NFTs (Non-Fungible Tokens). These new forms of art have not only challenged the conventional art markets but also brought a fresh wave of creativity and innovation, making art more accessible to a broader audience. This section delves deep into the rise of these unconventional art forms, analyzing their market impact and highlighting key milestones and personalities that have significantly contributed to their popularity.

Street art, once considered a form of vandalism, has now gained widespread acceptance and recognition. Artists like Banksy and Shepard Fairey have played pivotal roles in elevating street art into the mainstream. According to a 2022 report by Art Basel, the global street art market has grown by 20% annually over the last decade, with auction sales reaching $150 million. This surge can be attributed to the increasing acceptance of street art as a legitimate form of artistic expression and its appeal to younger, more diverse collectors.

Digital art, another unconventional form, has seen exponential growth, especially with the advent of advanced technology and digital platforms. Artists like Beeple have revolutionized the digital art scene, with his piece “Everydays: The First 5000 Days” selling for a record $69 million at Christie’s in 2021. The digital art market, supported by online galleries and social media platforms, has witnessed a 35% annual growth rate, as reported by Hiscox Online Art Trade Report 2023.

Arguably the most disruptive force in the unconventional art market is the emergence of NFTs. These blockchain-based digital assets have redefined ownership and provenance in the art world. The NFT market exploded in 2021, with total sales volume exceeding $25 billion, as per DappRadar. Pioneering figures like CryptoPunks and Bored Ape Yacht Club have become cultural phenomena, drawing attention from both traditional collectors and tech-savvy investors. NFTs have not only democratized art ownership but also introduced novel ways for artists to monetize their work.

In summary, the rise of unconventional art sales has reshaped the art market landscape. Street art, digital art, and NFTs have brought forth new opportunities for artists and collectors alike, challenging traditional norms and carving out significant market shares. As these unconventional art forms continue to evolve, they are likely to further disrupt and enrich the global art market.

Comparative Statistical Analysis

The comparative statistical analysis between conventional and unconventional art markets reveals intriguing trends and distinctions. Through a detailed examination of total sales volume, average price per artwork, and market growth rates, we can discern the evolving dynamics of the art world.

Conventional art sales, represented by traditional galleries and auction houses, have historically dominated the market. Over the past century, data shows that the total sales volume in conventional markets has consistently been higher. For instance, in 2022, conventional art sales reached a total volume of $65 billion, compared to $15 billion in the unconventional sector. This disparity highlights the established nature of traditional art venues and their stronghold on high-value transactions.

Average price per artwork also varies significantly between the two markets. Conventional art markets often feature masterpieces by renowned artists, driving up the average price per piece. In contrast, unconventional markets, which include digital art, street art, and other emerging forms, typically exhibit lower average prices. In 2022, the average price of an artwork in conventional markets was approximately $250,000, whereas in the unconventional sector, it stood at around $30,000.

Despite these differences, the growth rates of the two markets tell a different story. Unconventional art sales have been growing at a faster rate. From 2010 to 2022, the unconventional market experienced an annual growth rate of 12%, compared to just 4% in the conventional sector. This rapid growth is largely driven by increased interest in digital art forms, such as NFTs, and the rising popularity of street art globally.

Buyer demographics and geographical distribution also reveal contrasting patterns. Conventional art buyers tend to be older, more affluent, and concentrated in Western countries, particularly the United States and Europe. On the other hand, unconventional art buyers are generally younger, more diverse, and spread across emerging markets in Asia and Latin America. This diversification in buyer demographics is expected to further fuel the growth of unconventional art markets.

In conclusion, while conventional art markets maintain their dominance in terms of total sales volume and average price per artwork, the unconventional art market is rapidly gaining ground with its impressive growth rates and diversified buyer base. The two markets are not mutually exclusive; instead, they influence each other, with conventional markets slowly embracing digital and unconventional forms, thus enriching the broader landscape of art sales.

Factors Influencing Art Sales

The art market has always been a complex ecosystem influenced by a myriad of factors. Historically, economic conditions have played a significant role in determining the demand and supply of art. During periods of economic prosperity, disposable income increases, leading to higher investments in art. Conversely, economic downturns often result in a cautious approach, impacting art sales negatively. According to a study by the Art Market Research Institute, fluctuations in GDP growth rates have a direct correlation with the volume and value of art transactions.

Cultural trends also significantly impact art sales. Movements such as Modernism, Abstract Expressionism, and more recently, Digital Art, have reshaped the market by introducing new styles and mediums that attract different buyer demographics. For instance, the rise of street art and artists like Banksy has brought unconventional art into the mainstream, catching the attention of both collectors and the general public. Expert art historian Dr. Sarah Thompson points out that “cultural shifts often act as catalysts, pushing the boundaries of what is considered art and influencing market dynamics.”

Technological advancements have revolutionized the way art is created, marketed, and sold. The advent of online auction platforms like Artsy and Sotheby’s has democratized access to art, enabling a broader audience to participate in the market. Blockchain technology and NFTs (Non-Fungible Tokens) have introduced new ways of owning and trading art, adding layers of transparency and security. A case study on Christie’s auction house revealed that their first-ever NFT auction fetched over $69 million, highlighting the growing acceptance of digital art.

Social media has become a powerful tool in shaping public perception and driving art sales. Platforms like Instagram and Pinterest allow artists to reach global audiences instantly, creating opportunities for direct sales and collaborations. Renowned art dealer Claudia Muller states, “Social media has effectively broken down geographical barriers, allowing emerging artists to showcase their work alongside established names.” For further insights on how these factors interplay, readers can explore resources such as The Art Newspaper and Artprice.

Case Studies of Significant Sales

Art sales have always captured the imagination of collectors and enthusiasts alike. In the conventional art market, several high-profile sales have made headlines and set records. For example, Leonardo da Vinci’s “Salvator Mundi” sold for an astonishing $450.3 million at Christie’s in 2017, becoming the most expensive painting ever sold at auction. Similarly, Pablo Picasso’s “Les Femmes d’Alger (Version O)” fetched $179.4 million in 2015, further underscoring the enduring value of traditional masterpieces.

These significant sales not only highlight the immense monetary value attributed to conventional art but also set benchmarks for future transactions. The high prices achieved by these artworks often influence the market, driving up the value of similar pieces and attracting more investors and collectors to the field. As a result, the conventional art market continues to thrive, buoyed by these record-breaking sales and the prestige associated with owning such iconic works.

On the other hand, the unconventional art market has seen its own share of significant sales, particularly with the rise of digital art and NFTs (Non-Fungible Tokens). One of the most notable NFT sales was Beeple’s “Everydays: The First 5000 Days,” which sold for $69.3 million at Christie’s in 2021. This groundbreaking sale not only showcased the potential of digital art but also signaled a paradigm shift in how art is perceived and valued in the digital age.

Additionally, viral street art auctions have gained traction, with works by artists like Banksy fetching impressive sums. In 2018, Banksy’s “Girl with Balloon” sold for $1.4 million at Sotheby’s, only to partially self-destruct moments after the sale. This event not only captured global attention but also highlighted the evolving nature of art and its interaction with modern technology and media.

The impact of these unconventional sales on the broader market is profound. They signify a growing acceptance of digital and street art as legitimate and valuable forms of artistic expression. Moreover, these sales have encouraged the development of digital art platforms, providing artists with new avenues to showcase and monetize their work. As the art market continues to evolve, these significant sales in both conventional and unconventional realms will undoubtedly shape future trends and redefine the boundaries of art itself.

Future Trends in Art Sales

The landscape of art sales is undergoing a significant transformation, driven by technological advancements and evolving consumer behaviors. One of the most notable trends is the integration of blockchain technology. Blockchain offers a decentralized method for verifying the authenticity and provenance of artworks, which is particularly crucial in the art market where forgery remains a persistent issue. By providing an immutable ledger, blockchain enhances transparency and trust, making it a valuable tool for both buyers and sellers.

Artificial Intelligence (AI) is another emerging technology poised to revolutionize the art market. AI algorithms can analyze vast amounts of data to predict market trends, evaluate the potential value of artworks, and even create original pieces. AI-driven platforms are enabling collectors to make more informed decisions, thereby democratizing access to the art market. These technologies are not only streamlining transactions but also opening new avenues for artistic expression and discovery.

The influence of younger generations cannot be overlooked. Millennials and Gen Z are redefining what it means to collect art. Unlike their predecessors, who often favored traditional galleries and auction houses, younger collectors are more inclined towards digital and unconventional art forms. They are also more likely to use online platforms for purchasing art, driven by the convenience and accessibility these platforms offer. According to market reports, the online art market is expected to grow significantly, further indicating a shift towards digital and non-traditional sales channels.

Expert forecasts suggest that these trends will continue to shape the future of art sales. Market analysts predict a steady increase in the use of technology to facilitate transactions and enhance the overall buying experience. Reports also highlight a growing interest in sustainable and ethically sourced art, reflecting broader societal shifts towards environmental and social responsibility.

In summary, the future of art sales lies at the intersection of technology and changing consumer behaviors. As blockchain and AI continue to evolve, they will undoubtedly play a crucial role in shaping the art market, making it more transparent, accessible, and dynamic. The art world is on the cusp of a new era, where traditional and unconventional markets will coexist and thrive, driven by innovation and a new generation of art enthusiasts.

Conclusion

The statistical analysis of art sales over the past century reveals significant insights into both conventional and unconventional art markets. Key findings indicate that while traditional art markets, such as galleries and auction houses, continue to dominate in terms of sales volume and value, unconventional markets including online platforms and private sales have been rapidly gaining ground. This shift underscores the evolving landscape of art commerce, driven by technological advancements and changing consumer behaviors.

Understanding these dynamics is crucial for collectors, investors, and artists alike. For collectors, awareness of the growing influence of online art markets can provide new opportunities for discovering and acquiring unique pieces. Investors should consider diversifying their portfolios to include both conventional and unconventional art assets to mitigate risks and capitalize on emerging trends. Artists, on the other hand, can benefit from engaging with multiple sales channels to maximize their reach and revenue potential.

To navigate this complex and ever-changing market, stakeholders should stay informed and adaptable. Collectors might benefit from subscribing to art market reports and newsletters, attending both physical and virtual art fairs, and building relationships with trusted dealers. Investors should conduct thorough research, seek advice from art market analysts, and consider the potential impact of economic fluctuations on art prices. Artists should leverage social media and digital marketing tools to promote their work and connect with a global audience.

For further exploration, we recommend the following resources and related articles:

By staying informed and proactive, all stakeholders can better understand and navigate the complexities of both conventional and unconventional art markets, ultimately enhancing their ability to make informed decisions and achieve their objectives in the vibrant world of art sales.

This week’s popular products

- €27.03 – €127.52 Exc. Tax

Dark City Canvas Art Print

- €44.61 – €192.29 Exc. Tax

Dark Cityscape Framed Art Print

- €27.03 – €127.52 Exc. Tax

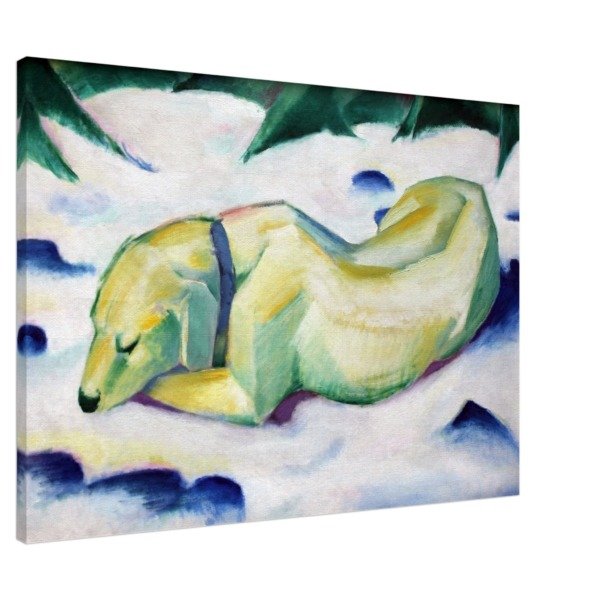

Franz Marc’s ‘Dog Lying in the Snow’ Canvas Art Prints